How to Apply for a Guaranteed SBA Loan Your Step-by-Step Guide

Jo Rawald • July 29, 2024

YOUR STEP-BY-STEP GUIDE TO FINDING A LENDER AND STARTING THE PROCESS

Hey there! 🌟 Ready to boost your small business with a guaranteed SBA loan? I’m thrilled to guide you through this process. Whether you’re looking to expand, buy new equipment, or manage cash flow, this guide will help you secure the funding you need with ease. Let's dive in!

Step 1 | Understand SBA Loan Basics

Before jumping in, get familiar with SBA loans. These loans are backed by the Small Business Administration (SBA) and are designed to help small businesses get financing with favorable terms.

The most common types are the 7(a) Loan Program and the 504 Loan Program. Each has its own benefits, so consider what best fits your needs.

Here’s a detailed list of SBA loan programs your small-business can apply for:

SBA 7(a) Loan Program

The most common SBA loan program, offering flexible terms for various business needs, including working capital, equipment purchases, and refinancing.

o Loan Amount - Up to $5 million

o Terms - Up to 10 years for working capital, up to 25 years for real estate

o Interest Rates - Variable or fixed, based on the prime rate

o Application Link - SBA 7(a) Loan Program

SBA 504 Loan Program

Provides long-term, fixed-rate financing for major assets such as real estate and equipment.

o Loan Amount - Up to $5.5 million for most projects

o Terms - Up to 25 years for real estate, 10 years for equipment

o Interest Rates - Fixed, typically lower than 7(a) loans

o Application Link - SBA 504 Loan Program

SBA Microloan Program

Offers smaller loan amounts to startups and small businesses, often through nonprofit community-based lenders.

o Loan Amount - Up to $50,000

o Terms - Up to 6 years

o Interest Rates - Variable, typically higher than 7(a) loans

o Application Link - SBA Microloan Program

SBA Disaster Loans

Provides financial assistance to businesses affected by natural disasters, including hurricanes, earthquakes, and floods.

o Loan Amount - Varies based on the disaster and the damage

o Terms - Up to 30 years

o Interest Rates - Fixed, generally lower than other SBA loans

o Application Link - SBA Disaster Loans

SBA Express Loans

Fast-tracks the application process for loans up to $500,000, providing quicker access to capital.

o Loan Amount - Up to $500,000

o Terms - Up to 7 years for working capital, 25 years for real estate

o Interest Rates - Higher than 7(a) loans but with a faster approval process

o Application Link - SBA Express Loans

SBA Veterans Advantage Program

Offers fee relief and special benefits for veteran-owned businesses applying for 7(a) loans.

o Loan Amount - Up to $5 million

o Terms - Same as standard 7(a) loans

o Interest Rates - Variable or fixed, based on the prime rate

o Application Link - SBA Veterans Advantage

SBA Community Advantage Loans

Provides access to capital for underserved communities and businesses in economically disadvantaged areas.

o Loan Amount - Up to $250,000

o Terms - Up to 10 years

o Interest Rates - Variable or fixed

o Application Link - SBA Community Advantage Loans

SBA 7(a) Small Loan

A subset of the 7(a) program, designed for smaller loan amounts with streamlined requirements.

o Loan Amount - Up to $350,000

o Terms - Up to 10 years for working capital, 25 years for real estate

o Interest Rates - Variable or fixed

o Application Link - SBA 7(a) Small Loan

SBA Export Loan Program

Provides financial support for businesses involved in exporting goods and services.

o Loan Amount - Varies based on export needs

o Terms - Up to 10 years

o Interest Rates - Variable or fixed

o Application Link - SBA Export Loan Program

SBA CAPLines Program

Offers loans for short-term working capital needs, including seasonal and contract financing.

o Loan Amount - Up to $5 million

o Terms - Up to 5 years

o Interest Rates - Variable or fixed

o Application Link - SBA CAPLines Program

Step 2 | Assess Your Business Needs

Clearly define why you need the loan. Are you expanding, buying equipment, or covering operating expenses? Knowing your needs will help you choose the right loan type and prepare a compelling application.

Step 3 | Check Your Eligibility

Make sure you meet the SBA’s basic eligibility requirements:

o Size Standards - Your business must be considered small according to SBA size standards.

o Type of Business -Certain businesses are ineligible, like those engaged in illegal activities or primarily lending.

o Location - Your business must be located and operated in the U.S.

o Good Character - You should not have a criminal record, and your business should be free from any recent legal

troubles.

Step 4 | Gather Required Documentation

Get your documents in order. The SBA requires a comprehensive set of paperwork to process your loan application. Here’s what you’ll typically need:

o Personal and Business Tax Returns - Usually for the last three years.

o Business Financial Statements - Profit and loss statements, balance sheets, and cash flow statements.

o Business Plan - A detailed plan outlining your business goals, strategies, and financial projections.

o Personal Financial Statement - A snapshot of your personal assets and liabilities.

o Credit Reports - Both personal and business credit histories.

o Legal Documents - Business licenses, registrations, and ownership agreements.

Step 5 | Choose a Lender

Find an SBA-approved lender. The SBA works with banks, credit unions, and other financial institutions that are authorized to offer SBA-backed loans. You can use the SBA’s Lender Match tool on their website to find potential lenders that suit your needs.

Step 6 | Complete the Loan Application

Fill out the loan application form provided by your chosen lender. This will include information about your business, the loan amount you're seeking, and how you plan to use the funds. Be thorough and accurate—this is your chance to make a great first impression.

Step 7 | Prepare for the Interview

Be ready for a meeting with the lender. They’ll likely ask you about your business plan, financials, and how you intend to use the loan. Practice your pitch and be prepared to discuss your business in detail.

Step 8 | Review and Sign the Loan Agreement

If approved, the lender will send you a loan agreement. Review it carefully to understand the terms and conditions, including interest rates, repayment schedules, and any fees. Seek advice from a financial advisor or lawyer if needed before signing.

Step 9 | Use the Funds Wisely

Once you receive the loan, use the funds for the purpose outlined in your application. Keep meticulous records and manage the funds according to your business plan to ensure you meet your financial goals and stay on track.

Step 10 | Repay the Loan

Stick to the repayment schedule and make timely payments. This will help you build a strong relationship with your lender and maintain a good credit standing for future financing needs.

There you go! With these steps, you’re all set to tackle the SBA loan application process and secure the funding you need to elevate your business. If you need any help or have questions along the way, feel free to reach out. Let’s get that business booming! 🚀

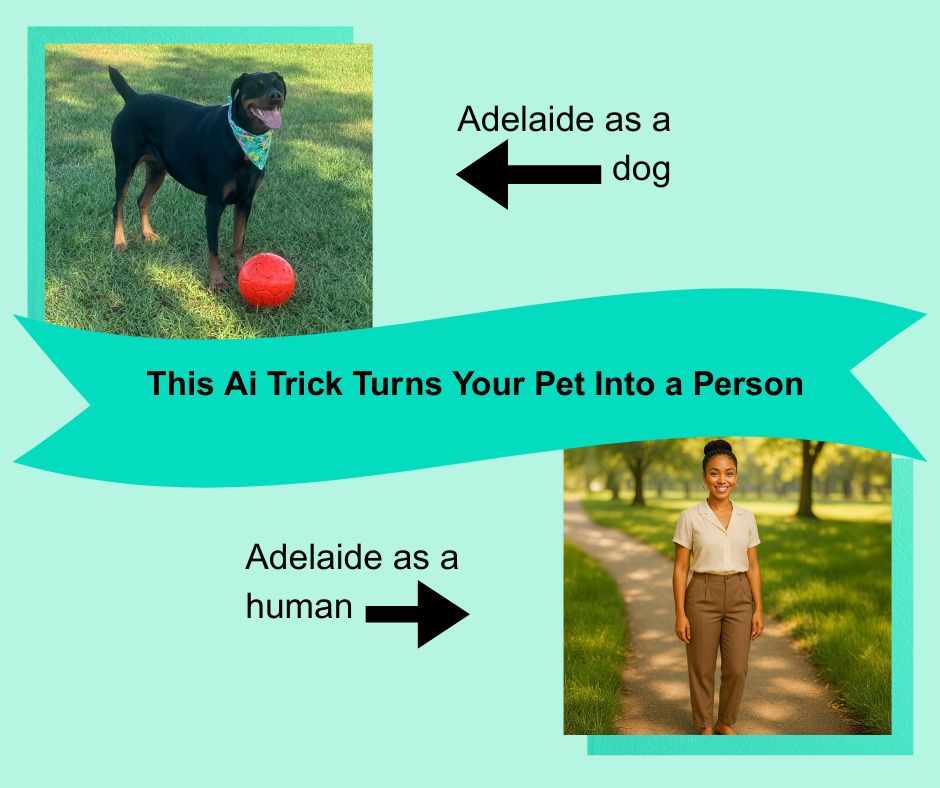

I went to a networking event yesterday at Rosie’s Bar & Grill in Wilton Manors. Tropical-chic to the max. You know the kind of place - upscale casual, strong cocktails, mandatory valet. Now usually, I’m all about valet. But not yesterday. I wasn’t there to sip martinis or hang around all night. I could only stay for 20-minutes. That means - I was on a serious 20-minute mission: say hi, shake hands, peace out. Then, get back in my car to jump on a Zoom meeting! I certainly wasn’t about to drop $20 just to park my car for 20 minutes. No way! I pulled into the valet area, looked the guy dead in the eye, and said, “I’ll be in and out faster than your last relationship. Can I just park it right here?” And bless his heart - he said yes. Honestly, that should’ve been my win for the night. But then I met Sean Gac-Guerrier. Sean’s the Marketing Director at Excel Title, Inc. We started talking about dogs - and **cue the angels singing. We clicked instantly. Not two strangers meeting, more like two childhood friends who hadn’t seen each other in a decade! Sean showed me a photo of his dog, Dottie. I pulled out pics of my girl, Adelaide. Then he pulled out a photo of Dottie that stopped me in my tracks. Sean had a photo of what Dottie would look like as a human. Not a cartoon. Not a filter. I’m talking AI-generated, fully humanized, real-world, cardigan-wearing, intelligent-and-intimidating Dottie. I was mesmerized! It was as if Pixar and the FBI teamed up to design her. I looked at Adelaide’s pic… then looked back at Sean… and blurted out, “I need to humanize my dog!!” And I did. I went home, found the exact AI prompt, uploaded Adelaide’s photo, answered a few fun questions about her personality, and style - then… BOOM. Human Adelaide was born. Tall, lean, cozy-chic, with that unmistakable “don’t-mess-with-me-but-I’ll-still-hug-you” vibe. She looked like she ran Homeland Security and still had time for tacos and espresso martinis on a rooftop. Honestly? I stared at the image for like five minutes. Because it wasn’t just about making something cute. It was about seeing something familiar - something you know - come to life in a new way. Here’s the AI Prompt if you want to try it yourself:

Leftovers are the fake friends of the food world. And you know what? That’s what a lot of businesses look like, too. They launch with energy. Get some quick wins. A few clients. One lucky viral post. They look like they’re set up to thrive…until pressure hits. The market shifts. Leads dry up. And suddenly - leftovers. Not sustainable. Not scalable. Definitely not long-term. That’s why I teach my clients to build like bamboo - strong, flexible, and BUILT TO LAST. My BAMBOO framework doesn’t chase trends. It builds foundations. At Brains, Brilliance & Bold Moves , I’m teaching how to outlast the noise, scale without stress, and build a business that actually pays you… year after year. No more business leftovers. No more "it looked like enough until you opened it." You deserve a full plate. 📍 May 7 in South Florida 🎟️ Claim Your Spot 🍷 Wine included. Obviously. Catch you in the room. Jo

If your business feels like one never-ending game of catch-up, we need to fix that. Too many women are drowning in busywork, doing too much, and seeing too little return. They’re hustling hard but not making real money. That’s not a business - that’s a burnout plan. B.A.M.B.O.O. - The Profit Formula That Kills Uncertainty and Fuels Rapid Growth

You don’t need more chaos - you need a business that runs like a machine. If you’re constantly scrambling, reinventing the wheel, or trying to keep up, your business doesn’t have a real structure. And without structure, scaling is impossible. Most business owners build their success on sheer effort instead of smart systems - and that’s why they burn out before they ever hit real revenue growth. What’s the Secret to a Bulletproof Business? B.A.M.B.O.O.

You’re working too damn hard for too little. You’re hustling, grinding, doing all the things - but where’s the payoff? If your revenue isn’t growing at the rate it should be, it’s not because you need to work more. It’s because you’re not maximizing what you already have. Scaling isn’t about doing MOR E. It’s about making every move count. You don’t need to add more services. You don’t need to post more on social media. You don’t need to exhaust yourself trying to be everywhere at once. You need a strategy that turns your existing efforts into higher profits, stronger cash flow, and sustainable success. B.A.M.B.O.O. - The Exact Business Structure That Makes Scaling Effortless

A while back, I was on a Zoom networking call. You know the kind - 30-second intros, a few breakout rooms, and a whole lot of wondering “Why am I even here?” When it was my turn, I gave my usual intro. Nothing fancy. Just clear and true: “I help women entrepreneurs simplify their systems, increase profits, and build a business that doesn’t burn them out.” Then we moved on. Nobody commented. Nobody asked a follow-up. I honestly thought it fell flat. But a few days later, I got a DM from someone in that meeting. She said, “I’ve been repeating your line to myself ever since. I think I need your help.” It stopped me in my tracks. Not because it turned into a sale (though it did)… But because I realized: clarity attracts. I wasn’t being flashy. I wasn’t over-explaining. I was just finally saying what I do, who I help, and how I help them - clearly, consistently, and unapologetically. And that one sentence? It stuck. That’s what I want for you. Because if your dream clients can’t repeat what you do… If your message is foggy, vague, or buried under “inspirational” fluff… They won’t hire you. They won’t refer you. And they won’t remember you when they need what you offer. That’s why I’m inviting you to: Brains, Brilliance & Bold Moves • A Workshop for Women Entrepreneurs Ready to Work Smarter & Profit Bigger 📍 May 7th | 6PM–8PM | Total Wine & More, Pembroke Pines, FL 🍷 Includes catered experience, wine tasting, & real strategy This is not a vision board party. This is a high-impact, hands-on evening designed to help you: ✅ Attract the right clients (without chasing anyone) ✅ Simplify your offers, systems & structure ✅ And create a business that’s profitable, sustainable, and crystal clear I’ll be walking you through the “A” in my B.A.M.B.O.O. Framework - Attract - and showing you exactly how to stop getting overlooked and start becoming the obvious choice. Ready to be heard — and remembered? 🔗 Save Your Seat Here It’s time to stop trying harder… and start showing up with clarity that sticks. Talk soon, Jo P.S. Know a woman whose message is powerful but messy? Forward this. Let’s get her showing up with client-magnet energy too.

A few years ago, I decided I was going to finally lose the pesky 10 pounds I had slowly put on over the years. I jumped online and found this weight loss coach who looked like a total dream - toned arms, glowing skin, every photo airbrushed to fitness-perfection. I followed her. Obsessed a little. Booked a 1:1 Introductory Zoom meeting with her to sign up for her program. Then she popped up on camera and… y’all, she didn’t even remotely resemble her photos. I’m not here to body shame - this isn’t about that. But she was clearly 60 pounds heavier than her brand claimed, and everything about the vibe felt… off. Here’s the point. It wasn’t about this woman’s size. It was about the brand disconnect. What she sold didn’t match what she delivered. She was coaching a transformation she clearly hadn’t made herself. I was confused and confused people don’t buy. Period. And that confused moment? It’s one of the reasons why I created my B.A.M.B.O.O. Framework. Because I don’t want you building a business that looks good online but crumbles under pressure. I want you building something that lasts. That grows with purpose. That holds its ground when the storms come. So why Bamboo ? Because bamboo is deceptively strong. It bends - but it doesn’t break. It thrives in chaos, survives in the harshest conditions, and grows fast when rooted deep. You can cut it back and it keeps coming. That’s the kind of business I help women build - durable, flexible, unshakable.

Let me tell you about a landscaping business in Kansas pulling in $1.2 million a year in gross revenues. Sounds like a solid business, right? Except for one little problem - over the past ten years, they racked up $1.3 million in unpaid invoices. That’s not just bad; that’s horrific. They weren't just doing work for free - it was costing them money to service a client's lawn! Their billing and collection system was a disaster. Clients were paying late (if at all), invoices were slipping through the cracks, and their bank account was bleeding cash. But here’s the kicker - they didn’t even realize how bad it was because their bank account never went into the negative. It came close a few times, but, as long as there was still $100 in their checking account - they thought they were doing fine. From that moment, when we discovered their 10-year Accounts Receivable balance was well into the 7-figures, we came up with a collections plan! I know what you’re thinking. “Jo, there’s no way you went back ten years and collected on old invoices.” Ohhhhh....but we did. And not just that - we re-invoiced and sent late payment notices for every single outstanding balance, even ones from a decade ago. But here’s the secret sauce - we didn’t just send out friendly reminders and hoped for the best. Nope. We threatened to report every single past-due balance to the IRS. [Keep reading if you want to learn more about how we did that]. Suddenly, those clients who had been ghosting them for years? They started paying real fast when they heard the IRS could get involved. And guess what? In just six weeks, we collected $1,079,000 a whopping 83% of what they thought was a lost cause. Now, let me be clear - that didn’t happen by magic. It wasn’t just about sending invoices. It took hustle, strategy, and relentless follow-up. But we did it. And once we got that money in the door, we put a bulletproof billing and collection system in place so they NEVER ended up in that mess again. Now? Today? They have a $0 balance on anything past 30 days. Clients pay ON TIME, cash flow is smooth, and they don’t have to chase down their own money anymore. So let me ask you - how much money are YOU leaving on the table? How many clients are you “hoping” will pay? How long are you willing to stay stuck, grinding without seeing the cash actually hit your account? Because here’s the truth - Hard work alone doesn’t equal profit. Strategy does. And that’s exactly why I created Brains, Brilliance & Bold Moves - a LIVE, in-person workshop in South Florida for women business owners who are DONE spinning their wheels and READY to get paid what they’re worth. This is where business owners learn how to make MONEY. B.A.M.B.O.O. - The Business Growth Formula That Refuses to Break Bamboo doesn’t chase sunlight - it grows straight to it. It doesn’t fight for space - it claims it. It doesn’t wait for perfect conditions - it expands anyway. Your business should be doing the same.

Every year on St. Patrick’s Day, Chicago pulls off one of the boldest marketing moves of all time. They don’t just slap a few shamrocks on storefronts and call it a day. No. They shut down streets, they throw massive parades, and they dye an entire river green. And guess what? It works. People show up in droves. They take photos. They talk about it for weeks. Because when you go that big, that bold, and that unapologetically loud, you become impossible to ignore. Now, let me ask you this - what’s your business doing? Too many entrepreneurs market themselves like a whisper. They post once in a while and hope clients magically find them. They keep their services under wraps like some exclusive VIP secret. They don’t want to be “too loud” or “too much.” And then they wonder why no one is buying. Meanwhile, the businesses making real money? They’re throwing a parade. They’re visible. They’re showing up consistently. They’re making noise. Not spammy, not desperate - just strategic, confident, and impossible to ignore. Here’s the Reality If people don’t know you exist, they can’t pay you. If you’re waiting for clients to just find you, you’re going to be waiting a long time. The best brands aren’t the best-kept secrets - they’re the ones that know how to make themselves seen. So, how do you stop being invisible? How do you turn your business into something people can’t stop talking about? That’s exactly what I’m teaching at Brains, Brilliance & Bold Moves - a hands-on workshop for women entrepreneurs who are done waiting quietly and ready to attract clients with confidence. On May 7th at Brains, Brilliance & Bold Moves in South Florida, we’re covering: • How to market yourself like a parade (without feeling salesy) • How to attract dream clients instead of chasing bad ones • How to fix your cash flow so you always know where your next dollar is coming from • The exact strategies to get seen, get paid, and stop wasting time This isn’t theory. It’s action. If you’re a woman business owner, grab your seat now. If you know a woman entrepreneur who needs to stop waiting in the shadows, send this her way - she’s welcome. Sign up here See you May 7th. And hey - if Chicago can turn a whole river green, you can show up and promote your blimey business.

Have you ever had that gut feeling that something was off - like you just knew something wasn’t right? You pull up somewhere familiar - somewhere you go all the time - and yet, something feels… off. Your gut tightens. Your instincts go on high alert. You don’t have proof that anything’s wrong, but you sure as hell aren’t about to ignore that feeling. That was me the other morning at the dog park. And let me tell you - my instincts? Dead on. The Routine That Got Disrupted Adelaide and I have our morning routine down to a science. Dog park, 6:45 AM, five days a week. She’d love to go every day, but, you know, I got work commitments.